Tad DeVan is a Senior Forex Analyst for Market Traders Institute and host of the Ignite Trading Room. Ignite Trading Room is FREE to join for active SmartTrader users. CLICK HERE to join today >>

Fibonacci extensions are a great tool for traders to determine where the market is likely to be going next. In today’s blog, Tad shares how you can quickly analyze any currency pair on four time frames using Smart Fibonaccis. Quickly apply this smart tool, which can help give you a better idea of the market movements so you can place your trades for some potential wins.

Today’s lesson is going to be an interesting one.

I’ve been talking about Fibonaccis for quite some time now. And today, we’ll go over a strategy through which you can analyze any currency pair on multiple time frames using Smart Fibonaccis to determine which direction the markets are likely to move.

What’s amazing about this strategy is that it’s simple and takes just a couple of minutes to use over various time frames on your charts.

Let’s dive in…

Take the USDJPY pair as an example.

For rapid analysis, we will analyze this currency pair on four different time frames – hourly, 4-hour, weekly, and monthly – to determine which direction the pair is likely going to move ahead.

Starting with the monthly chart…

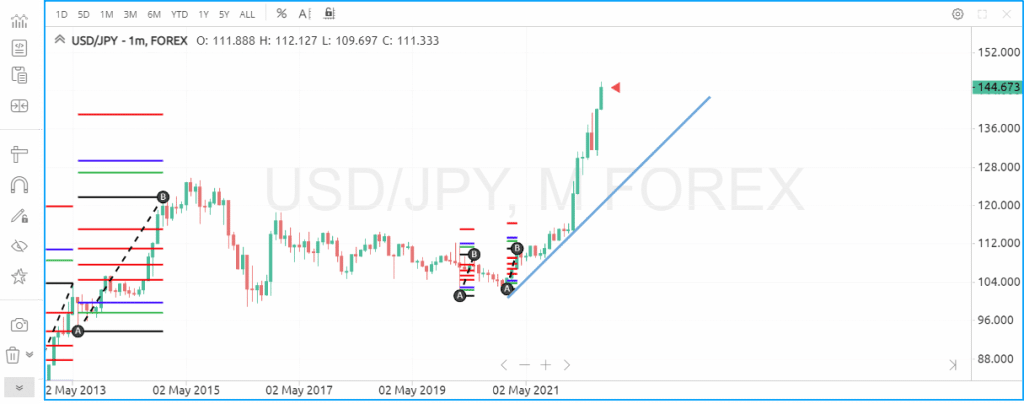

USDJPY Monthly Chart

The USDJPY currency pair has been in an uptrend lately.

Here’s how you can apply Smart Fibonacci on it:

Open up a new chart on your SmartTrader trading platform on which you want to place the Smart Fibonacci.

Next, go to the indicators list located at the top of the chart and click on the ‘Smart Fib’ ABCD button. Next, place your cursor below the recent lowest price level on the chart and click – this will automatically clock all the Fibonacci levels on your chart.

Here’s how it should look:

As seen in the chart above, we have an up AB line which shows that overall, the currency pair has been in an uptrend.

Now, stretch a smart trendline through the point A and extend to the next low level on the chart.

As seen in the chart, there is no trendline break and that tells us the currency pair is likely to be moving in an uptrend ahead.

With that in mind, let’s now move on to the weekly chart.

That’s because the monthly chart controls the weekly direction, the weekly direction controls the daily direction, and the daily direction controls the 4-hour, and so on.

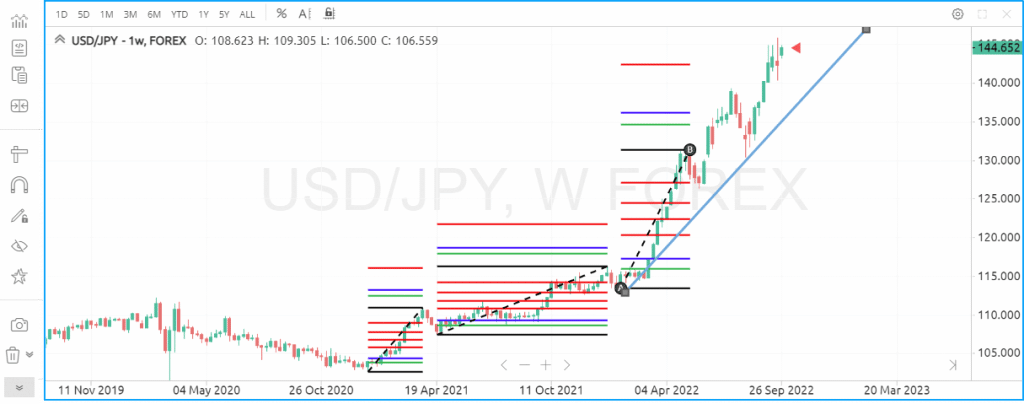

The steps remain the same. We place Smart Fibonacci on the chart, extend the trendline from lowest or highest level to the latest highs or lows, and see what direction it stretches out to.

Here’s a look:

USDJPY Weekly Chart

As we can see, there’s no trendline break in the weekly chart as well and that tells us the currency pair is likely to be moving in an uptrend ahead.

Similarly, we repeat the same exercise on the 4-hour and hourly chart for USDJPY.

If all the charts show us a similar pattern in the trendlines, we can determine how the currency pair is likely going to move ahead. And with that information, we can strategize our trades to target quick potential profits.

So there it is – a simple and quick way to analyze the direction of the market or any currency pair using Smart Fibonaccis on larger timeframes and moving on to smaller timeframes.

Do check it out the next time you’re on your charts!

I have also recorded a short video on this concept, which you should WATCH HERE >>

For more such Forex strategies and trades, you can check out my Analyst On Demand Trading Room.

It’s where I’ll take you through real market conditions and guide you on your journey to becoming a consistent trader across the board. Access it by clicking HERE >>

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for everyone. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before getting involved in foreign exchange you should carefully consider your personal venture objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial deposit and therefore you should not place funds that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. The information contained in this web page does not constitute financial advice or a solicitation to buy or sell any Forex contract or securities of any type. MTI will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.