There is a lot of talk and building hype these days for the promise of computer programmed, algorithmic or automated trading. These tools go by names like Trading AI, Robotrading, and Automation. Some of these “black box” tools make impressive claims about winning percentages and average gains. The premise behind each of these tools and the reason they are so appealing is they promise to help those who spend their time making money also enjoy profit opportunities the market offers without all the hassle or time required to learn how to actually trade.

These tools can be a great support as individuals seek to put their money to work and grow their retirement. The struggle is that this technology is still in its early phases. Much of it is unproven (or failed) during “black swan” events sometimes experienced in the markets. The great lockdown and economic freeze caused by Covid-19 is one such example where unexpected and unprecedented market volatility caused many of these programs to fail.

At this point in the development of these systems, it still behooves the average smaller investor to involve themselves in the process of putting their money to work in the markets. It behooves them to spend the necessary time and money to get educated about market probabilities and the tactics and techniques that can or should be used to successfully trade in different market environments.

There is enormous potential for creating wealth in the markets. In fact, most people will never be able to earn enough to be wealthy or to build a big enough retirement so they don’t have to worry about money. But putting money to work successfully (even through automation) takes effort and time and requires a good understanding of the tradeoffs between approaches especially in the early stages of employing this black box technology.

For example, any system that purports to give both a high winning percentage and large profits per trade is not one that should be trusted as it as a high likelihood of failing to hit the target win rate or the promised profits especially as markets change.

Trading in a trending market has an expected probability of very large wins but will only win on about 40-45% of trades made. In other words, traders working to capture the potential of larger gains that come from trending markets, expect to lose more often than they win and they also expect that their average gain is twice the size (or more) of their average loss.

Those who choose to scalp the markets take the opposite approach. They expect to win more frequently than they lose and they also expect their average loss to be twice the size of their average profit.

Scalpers and trend traders should understand these basic expected probability and find automated systems that reflect their desired market approach. They should also determine what tactic or strategy their chosen algorithm is using to increase its edge in the markets to further refine and improve these expectancies.

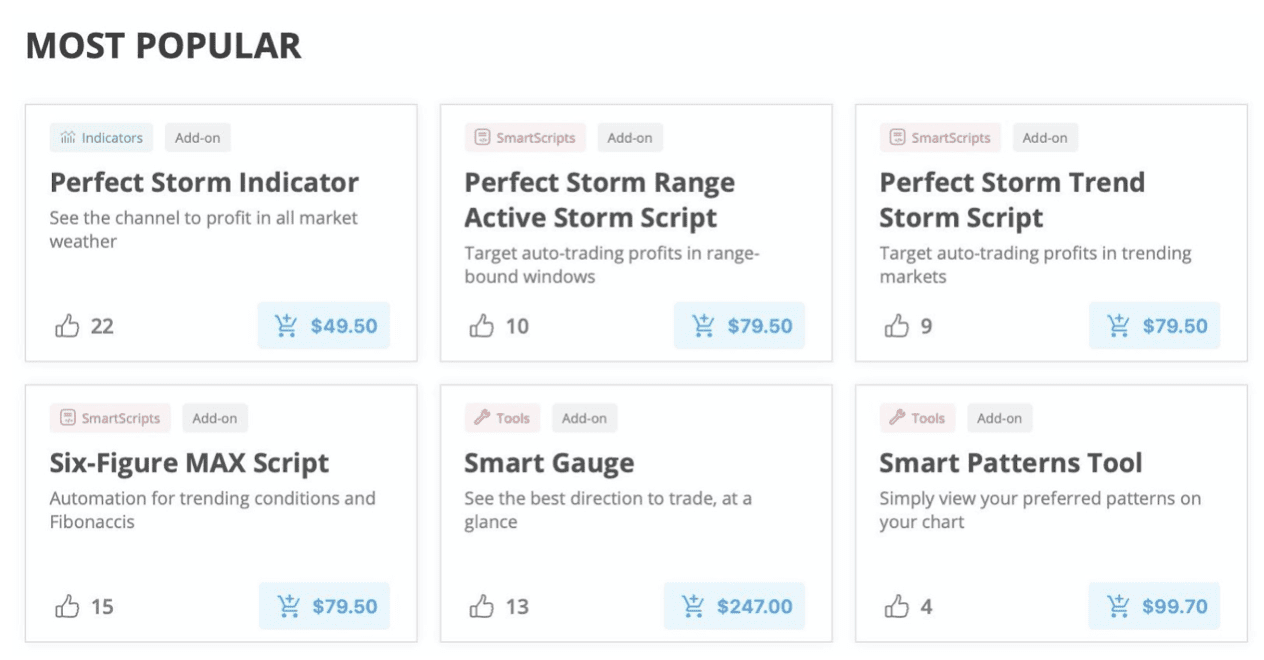

MTI has a number of inexpensive automated and educational programs which allows the smart trader to become increasingly knowledgeable about the markets and the strategies and tactics that work and are proven while also carefully incorporating automation into their process to further improve their results. Below is a screenshot showing some of the most popular tools: