In a previous article we shared how to find entry points using the simple strategy of entering a short position only on a bounce down off the downward trending resistance line. But what happens when the trend changes? Or worse, when the volatility increases and it seems like the market is moving in two directions at the same time?

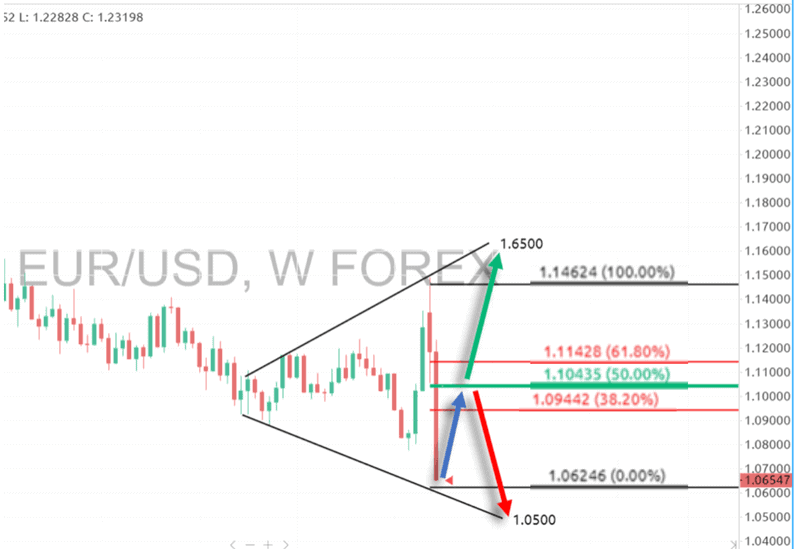

See the weekly EUR/USD chart below. This chart shows what is known as a Broadening Formation which often show up during periods of higher volatility. This pattern depicts what we expect to happen when it seems like the chart is moving in two directions at the same time.

In this case, the midpoint between the two bullish and bearish trend lines is 1.10435. The expectation is that when the price is below this midpoint, it will rise to the midpoint (blue arrow) and either continue up to the bullish trend line (green arrow) or bounce down off the midpoint and head back down to the bearish trend line (red arrow).

It really doesn’t matter what direction it ultimately chooses to take. Your job is to take advantage of opportunity and protect yourself from loss. The trade setup in this instance is to be bullish on any bounce up off the bearish trend line, but only until the midpoint line. If the currency breaks up through this line, a new entry can be made to ride it up to the expected resistance of the bullish trend line.

One dynamic of this broadening formation is that each trade between the two trend lines can be more profitable than the previous trades as the distance between each trend widens.

This formation can be played until the market settles down and establishes a new and more obvious direction. To give themselves an even greater edge, some traders add momentum indicators to the chart to help them better time entries and exits using short-term reversals.

The market moves in cycles. Successful traders learn to identify consistent patterns in these cycles and to trade those patterns over and over again. Consistently following your strategy, keeping tight stops and protecting your profits is the key to becoming a successful Forex trader.