Tad DeVan is a Senior Forex Analyst for Market Traders Institute and host of the Ignite Trading Room. Ignite Trading Room is FREE to join for active SmartTrader users. CLICK HERE to join today >>

Fibonaccis are a great tool for traders to use when selecting an exit target. But did you know that the market also has a tendency to react at the 1.27 extension level? In today’s blog, Tad shares how the market often reacts at this level based on different time frames and directions.

Today, we’re going to reveal one of our favorite things to look for on Fibonaccis – which isn’t the de-extension target, but rather something known as the 1.27 level and how the market tends to react to it over and over.

Here’s the amazing thing…

It’s a strategy which you will learn once and would then see it all over the place on every currency pair you apply the Fibonaccis to. And with that knowledge, you can try to predict what the market is going to do next and place your trades accordingly.

Let’s dive in…

Here’s a bit about Fibonacci levels… In finance, Fibonacci retracement is a form of technical analysis tool used to determine support and resistance levels. It’s named after the Fibonacci sequence of numbers, whose ratios provide price level information to which the market tends to react. And traders can then place trades with this information for potential profits.

The 1.27 Fibonacci Level

The 1.27 is a Fibonacci extension level but it’s not always a Fibonacci de-extension target. What that means in simple terms is that the market likes to react and bounce off at this level.

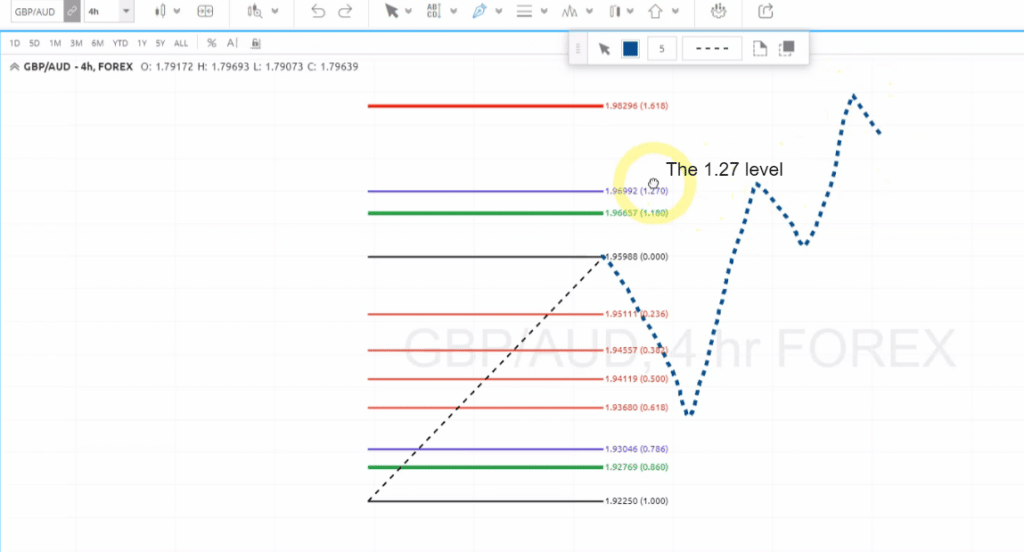

Here’s what this pattern looks like…

How the Market Reacts at the 1.27 Level

As seen in the image above, the market rallies from the 0.61 level all the way up to the 1.27 level before it falls and bounces back.

You can see this play out on all charts and on hourly, daily, weekly, and even monthly time-frames.

So, whenever we see the market or any asset touching the 1.27 level, we know there’s likely going to be a pull-back. And voila – we can now place our trades for some quick potential profits.

Here’s how you can place it on your charts…

Using Smart Fib on SmartTrader

Open up a new chart on your SmartTrader trading platform on which you want to place the smart Fibonacci.

Next, go to the indicators list located at the top of the chart and click on the ‘Smart Fib’ button. This step will automatically clock the Fibonacci levels on your chart.

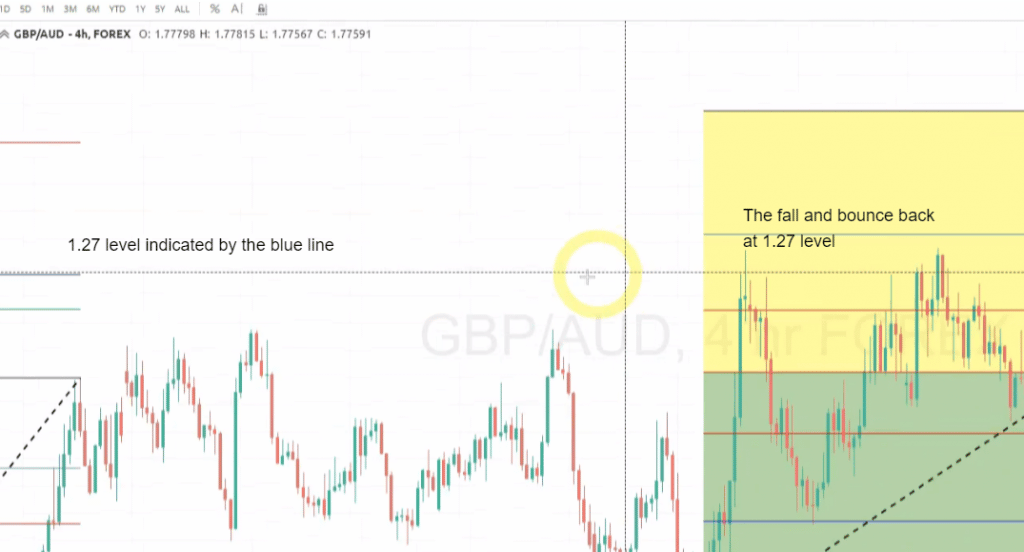

Here’s how it should look:

Now have a look at the 1.27 Fibonacci level that’s indicated with the blue line and notice how the markets reacted at these levels.

After touching the 1.27 level, the market fell just to again bounce off to another high Fibonacci level.

What this signal shows us is that we can look to sell at the 1.27 level. So there’s a good chance that the market can pull-back from there.

Plus, we can also look to buy the dips after the 1.27 level. That’s because the market can bounce back from those dips.

So that was the hidden Fibonacci level to spot market trends for some potential profitable trades.

It’s an amazing indicator of support and a downtrend, as well as an indicator of resistance and an uptrend.

Do check it out the next time you’re on your charts!

I have also recorded a short video on this concept, which you should WATCH HERE >>

For more such Forex strategies and trades, you can check out my Analyst On Demand Trading Room.

Every week, within the trading room, I’ll take you through real market conditions and guide you on your journey to becoming a consistent trader across the board. Access it by clicking HERE >>

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for everyone. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before getting involved in foreign exchange you should carefully consider your personal venture objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial deposit and therefore you should not place funds that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. The information contained in this web page does not constitute financial advice or a solicitation to buy or sell any Forex contract or securities of any type. MTI will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.