Trading with a Plan

Good Forex traders approach their trading with a specific set of rules referred to as a trade plan. These are rules the trader has either copied from a successful trader willing to share their proven system, or they are rules they’ve learned the hard way through expensive trial-and-error.

This set of rules can be different for every trader. That is a great thing about the currency market. You can trade it in many different ways with many different strategies.

If you don’t have a clear strategy, get one. If you haven’t codified your strategy into a set of written rules in the form of a trade plan, do it. And do it right now.

The first key to success is over time is adherence to rules regardless of individual trade outcomes. You can’t be a “gunslinger” with the quickest draw and straightest aim and expect to make money in Forex trading over the long haul.

Need a jump start on your trading plan? Download our free Cornerstones e-book today.

Forex traders frequently make very short term trades and can pile up many trades in a single day. This frequency of trading exerts a mental and emotional toll on the trader. If the trader approaches the markets like a gunslinger, they’ll get tired and start making mistakes which will take them too long to recognize because they have no real expectation for each trade.

On the other hand, traders who focus on following their system don’t make the same number of mistakes when they get tired because they have an expectation of outcome and any deviation is recognized and addressed quickly.

So the first key to success is developing and following your own, personalized trade plan.

The second key to success is knowing when to make changes to that trade plan. Inexperienced or uneducated traders make changes to their plan whenever they take a loss or whenever they miss out on extra profits. Experienced traders only make changes to their plan when it’s obvious the markets have changed and they need to adjust their approach.

This recognition and realization doesn’t happen with one losing trade. Traders may experience several losing trades before they allow themselves to begin making careful adjustments to their trade plan.

A trader’s set of rules gives them an expectation for individual trade outcomes and also an expectation of profit outcomes from a number of trades over time. Developing your skills as a trader only comes as you develop your ability to identify and then follow the rules in your trade plan.

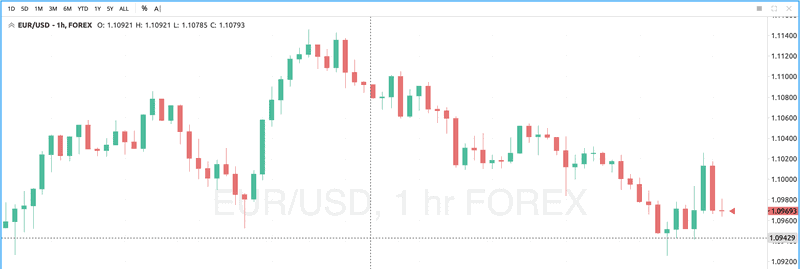

Below is an hour chart of the EUR/USD showing 79 trading periods:

This is what the market did over these one-hour periods. A plan for taking what the market gives you will help you be much more successful over time (and more consistently) versus just throwing money into a trade and hoping for a profit.