Are you so busy trading that you can’t make any money?

In real estate it’s said that the three key rules for success are:

- Location

- Location

- Location

In trading, it’s said that you need to learn to cut your losses short and let your profits run.

The question is, are you letting your profits run?

It’s natural to approach trading with excitement and enthusiasm and, let’s face it, a little greed about just how fast you’ll be able to turn your financial situation around or make a lot of money.

So you set up and fund your account and prepare yourself to trade. Hopefully, you’ve studied the markets and learned to use the charting tools found on SmartTrader. Hopefully, you’ve found a system that you have a natural aptitude to follow and which you have practiced using via paper trading over a number of trades. Hopefully, you’ve structured your environment to give you a place where you can focus on your trades during your trading day.

Take advantage of state-of-the-art tools and hundreds of popular indicators with SmartTrader.

The first few trades may all go as planned. But then the market does something unexpected and you lose money. Sometimes the memory of that loss is so strong that it becomes very difficult to let your profits run.

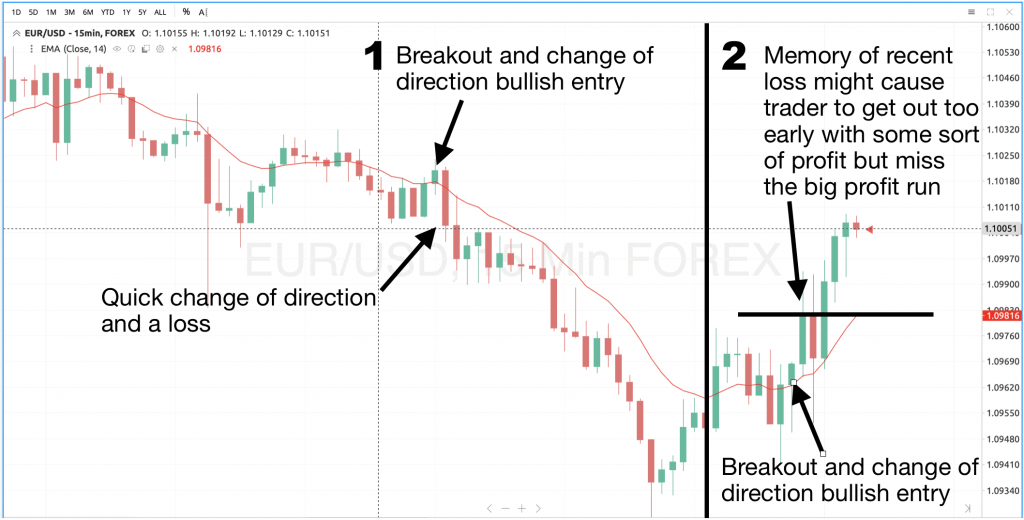

Below is a 15-minute chart of the EUR/USD. Now let’s assume your trading rule is to buy on any breakout where the 14-period EMA changes direction.

This chart shows two different possible trade setups using the simple system described. In (1) above, the chart gave us our signal and we took the trade, only to have it immediately turn around and cost us money. In (2) above, the chart gave us a signal and we took the trade and got out with a small profit. We might be happy with this profit at first…but then it keeps running and we miss out on the bigger profits we could have made. So what are we tempted to do? We beat ourselves up as a failure because we didn’t make the perfect trade.

A big risk for any trader is to let the memory of a recent loss (or string of losses) affect our ability to take advantage of the next opportunity. Each trade should be forgotten as soon as we’re out and any new trade should be approached without any emotional baggage from past trades.